Underrated Ideas Of Tips About How To Reduce Debt To Equity Ratio

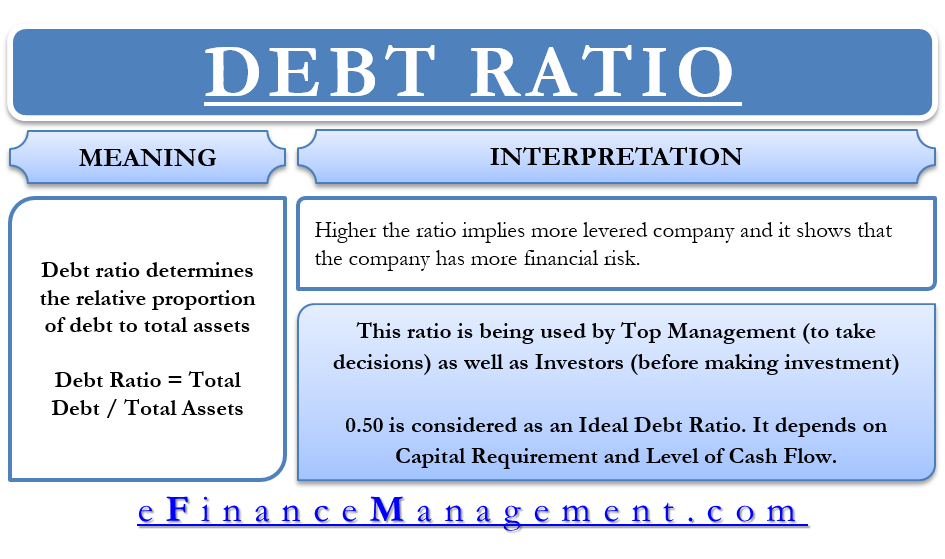

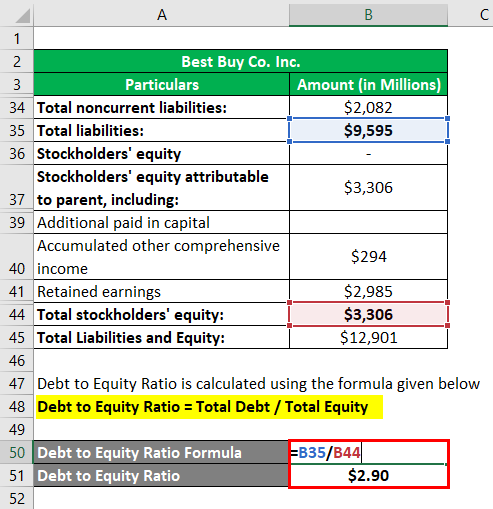

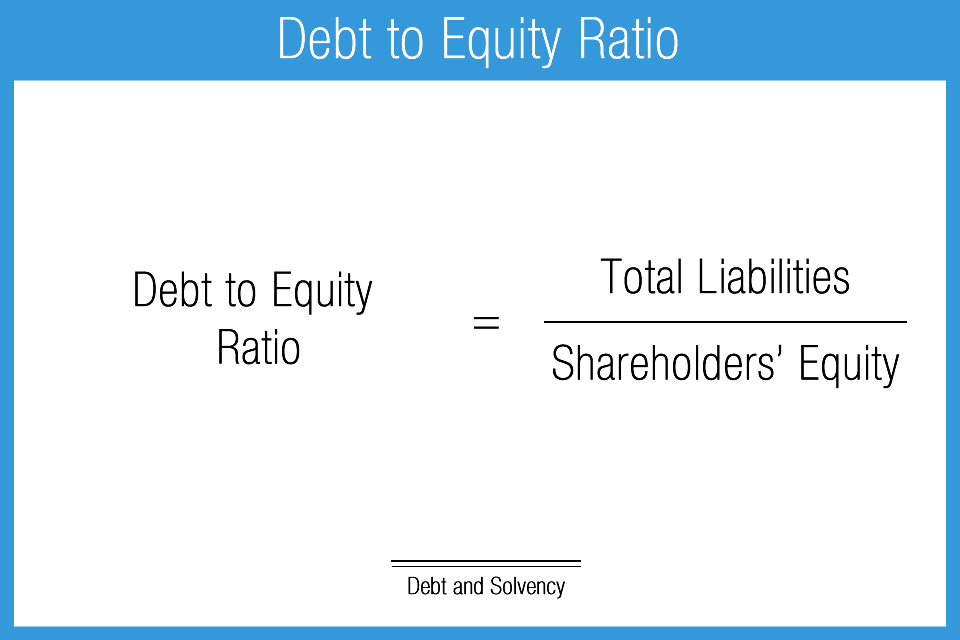

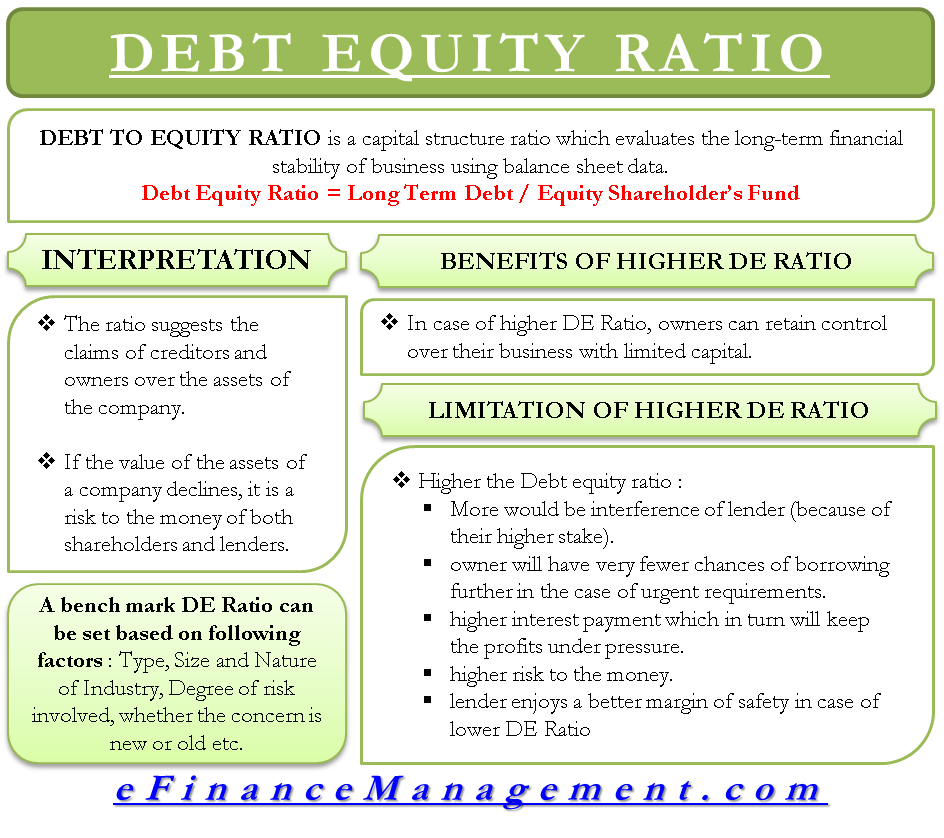

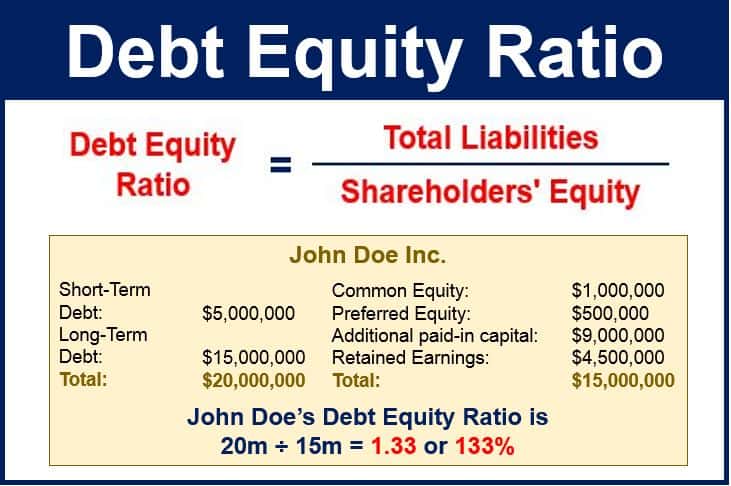

Debt to equity ratio = total liabilities / shareholder’s equity.

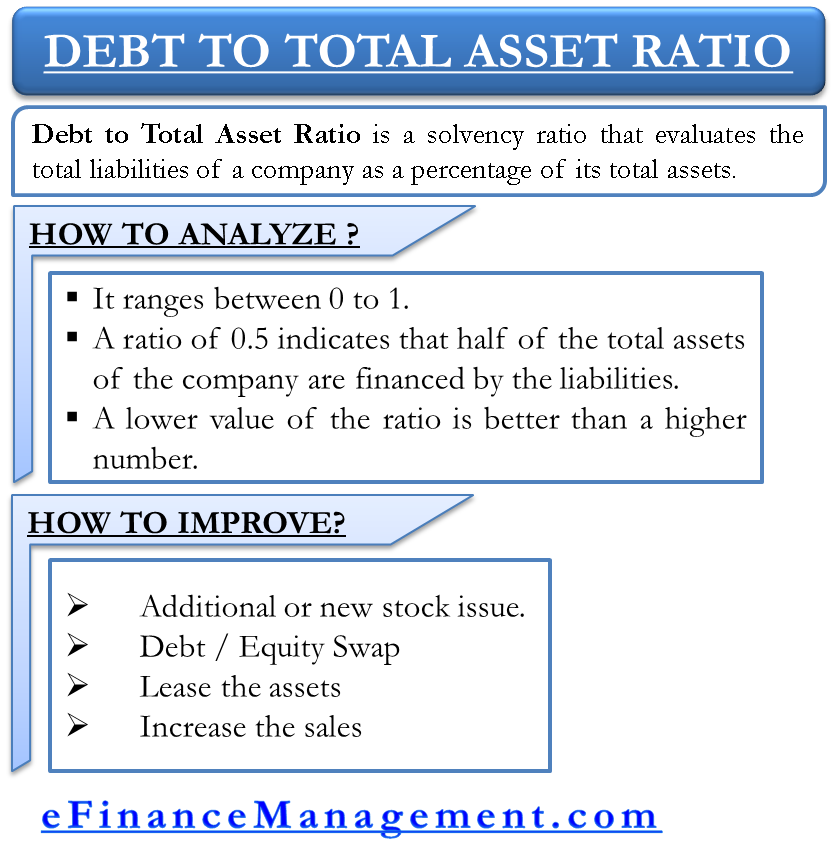

How to reduce debt to equity ratio. Debt restructuring through effective strategies increase equity. In this calculation, the debt figure should include the. Begin by compiling a listing of all your fundings as well as charge card.

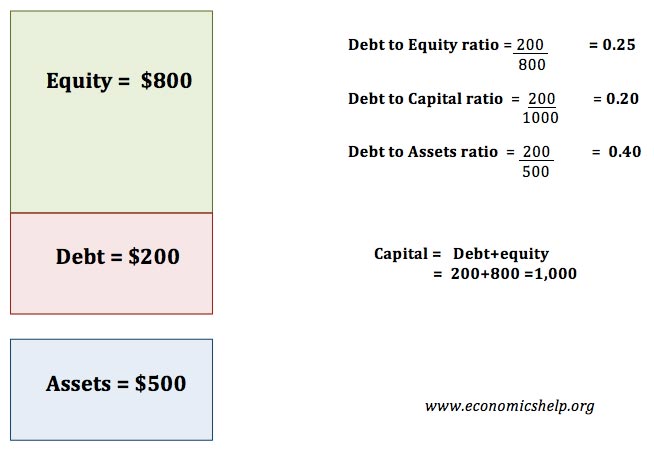

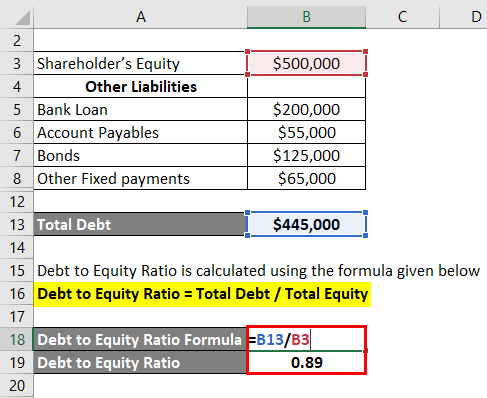

How to calculate the debt to equity ratio to calculate the debt to equity ratio, simply divide total debt by total equity. Debt to equity ratio = total debt / shareholders’ equity long formula: Total shareholders’ equity = (common stocks + preferred stocks) = [ (20,000 * $25) + $140,000] = [$500,000 + $140,000] = $640,000.

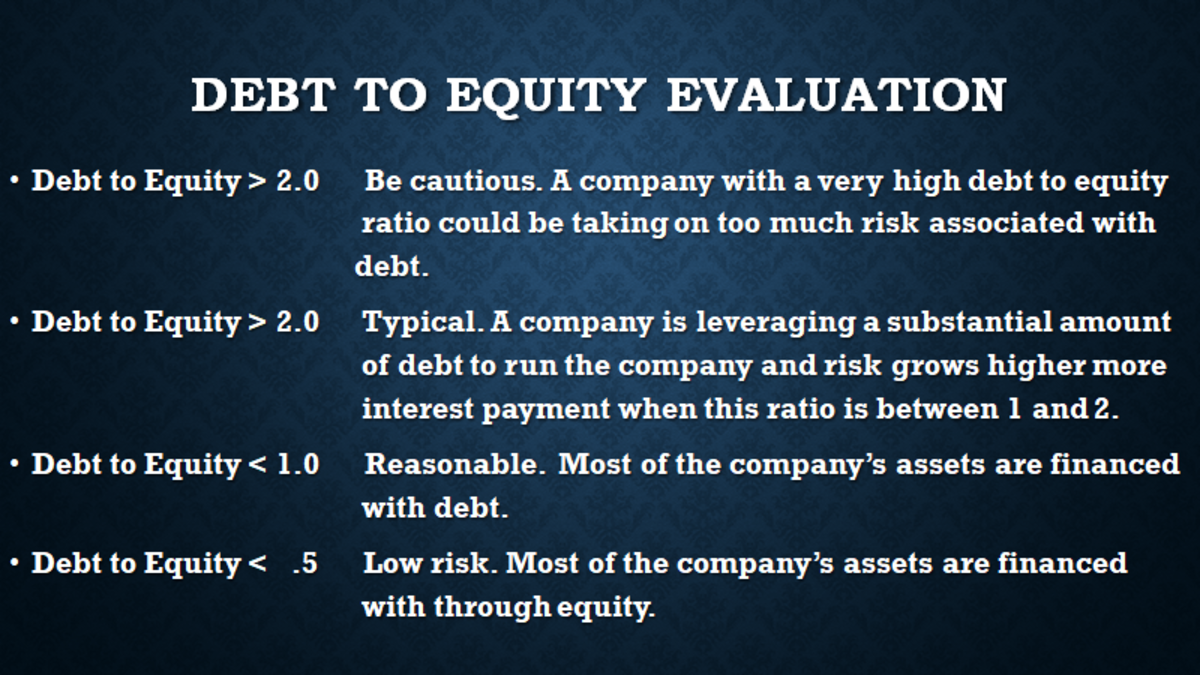

The first step to calculate the d/e is to find the total liabilities entry on the right side of the balance sheet and then put that in the numerator of the ratio. Debt equity ratio = total liabilities / total shareholders’. Sometimes the entity might use 50% debt and 50% equity.

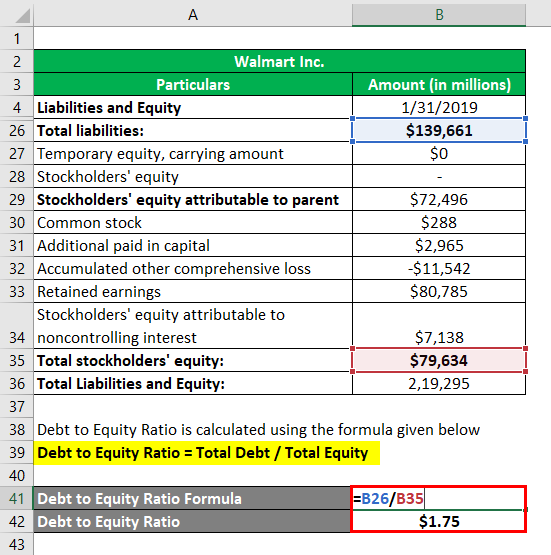

Financial leverage is referred to as the entity’s policies on using the fund for its operation. Debt to equity ratio = 1.75. Debt to equity ratio = (short term debt + long term debt + fixed payment obligations) /.

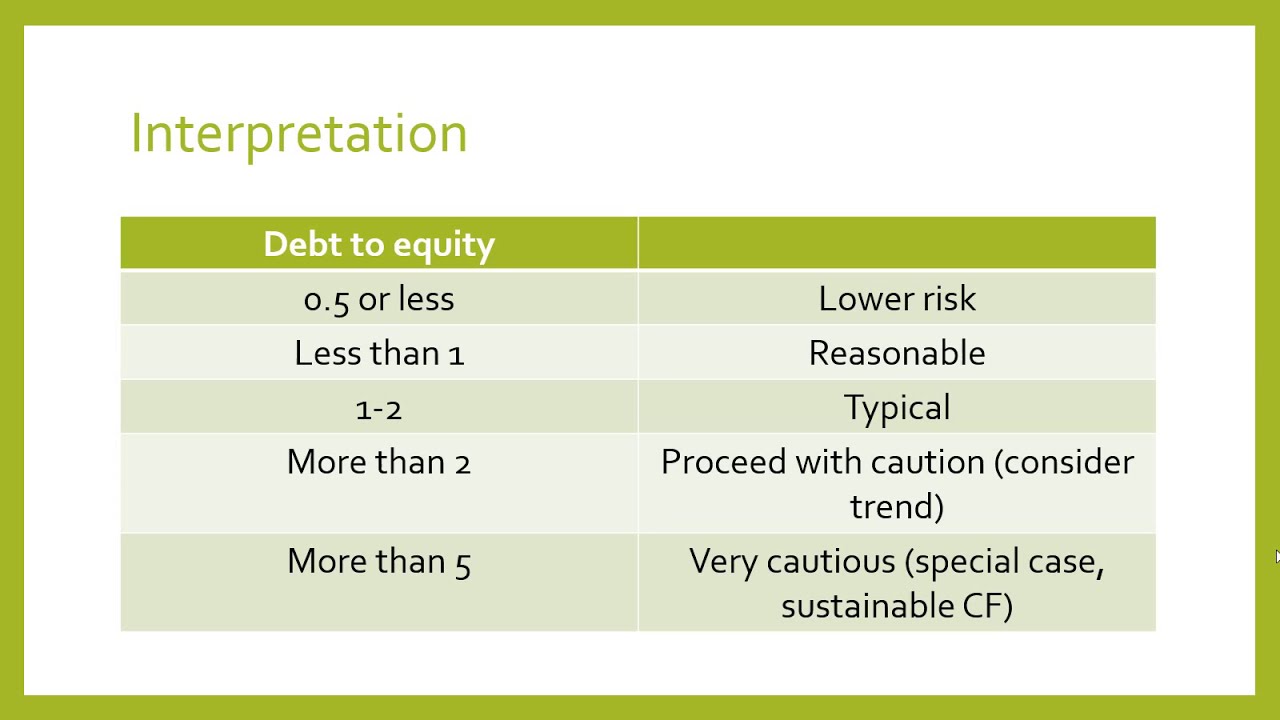

The formula for the debt to equity ratio is: Increase revenue and use the new equity to either buy new assets or pay off existing debts. For example, 3 and 4 if we compare both the company’s debt to.

One of the most effective ways to do this is to increase revenue. Debt to equity ratio = $139,661 / $79,634. 1) improve your financial leverage.

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

:max_bytes(150000):strip_icc():gifv()/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)