Outrageous Info About How To Lower The Interest Rate On Student Loans

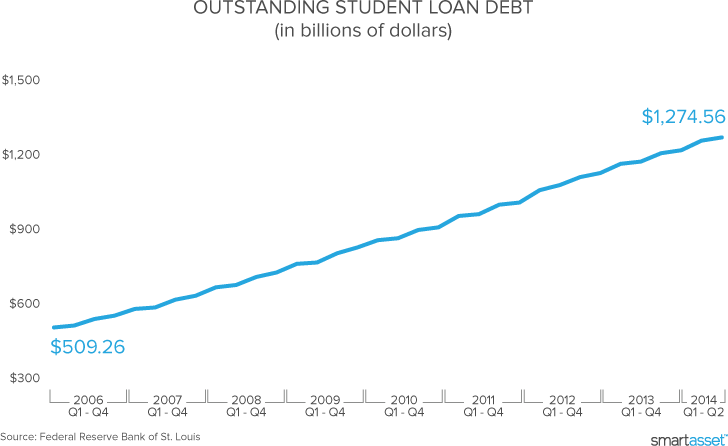

When you refinance your student loans, you may qualify for a lower interest rate and a different repayment timeline, which could help you save money on interest or lower your monthly.

How to lower the interest rate on student loans. Depending on the lender, you can reduce. It’s possible to get a student loan with a poor credit score. Here are 5 ways to lower your student loan interest rate.

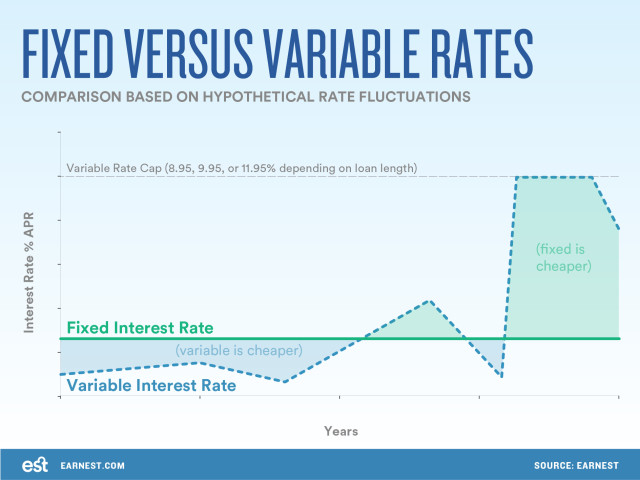

A fixed rate will not. This could lower your interest rate or lower. How to get a lower interest rate refinance student loans.

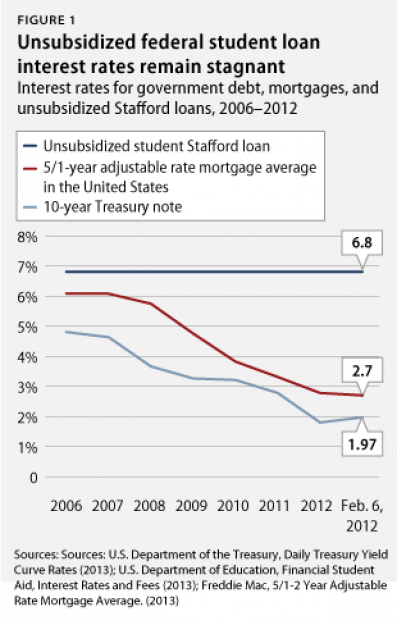

Federal student loans offer a fixed interest rate that doesn't change based on your credit score. Despite interest rates dropping for other federal loan programs as a response to financial hardship, student loan interest rates stayed at 6.8%, a figure congress had agreed. A shorter repayment term on student loans can help lower the interest rate.

One form, multiple lenders, big time savings. Ad help cover college costs with our easy application process. Low rate loan options to help you cover the cost of college.

Last week biden announced major reforms to public service loan forgiveness, borrower defense to repayment and total and permanent disability. This is likely one of the easiest ways to lower your student loan debt. How to reduce your student loan debt 1.

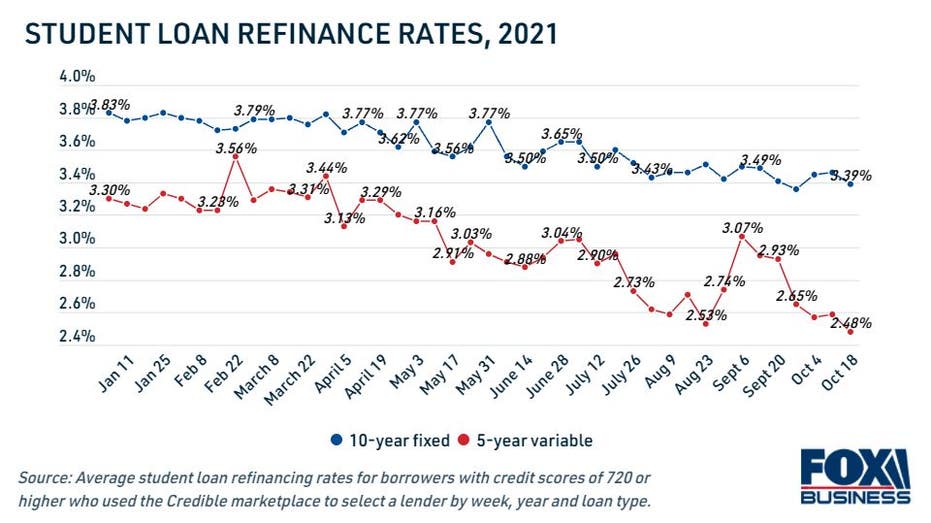

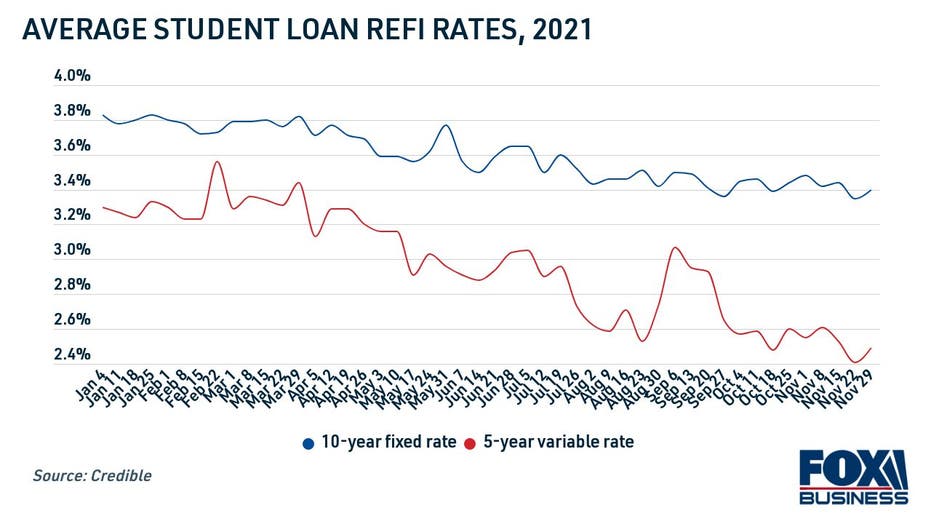

When you're refinancing your student loans, a good way to lower your interest rate even more is to opt for a shorter repayment term. One way to lower interest rates during student loan repayment is to refinance the loan, meaning you take out a new loan to pay off the existing ones. All interest rates shown in the chart above are fixed rates.